My Account

Follow us on:

Powered By

Learn, discover & invest in smallcases across different types to build your long term portfolio.

Invest Now

Explore from India`s leading investment managers and advisors curating their strategies as smallcases.

Invest Now

Powered By

Diversify your portfolio by investing in Global brands.

Invest Now

Pre-configured baskets of stocks & ETFs that you can invest

in with a single click. Developed by hedge funds, global

asset management companies, experienced wealth

management firms and portfolio managers.

Invest Now

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

STOCKAXIS EMERGING MARKET LEADERS

15-20 High Growth Stocks primed for price jumps

Subscribe

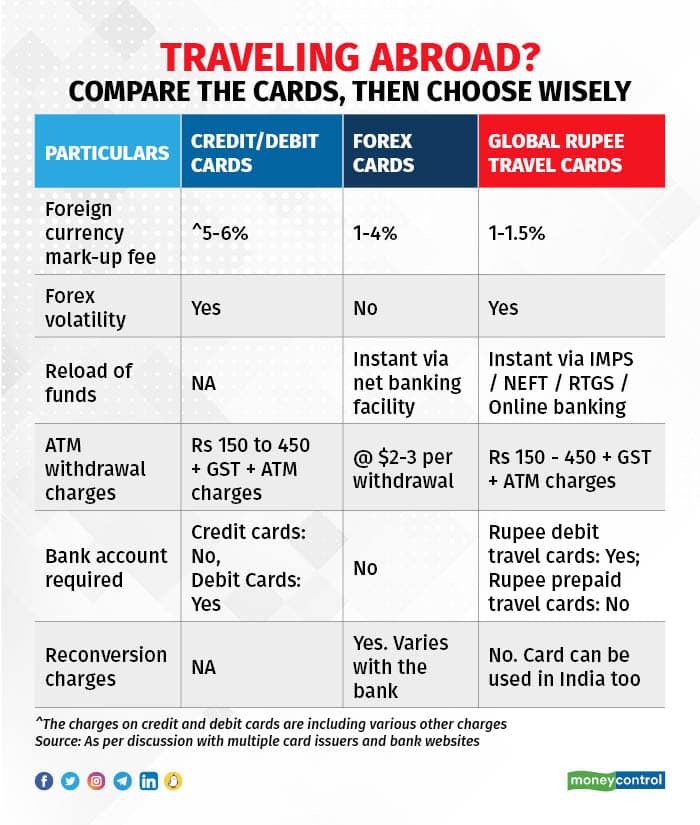

Over the last few years, a forex card has become a popular travel companion for many travellers. A forex card is a prepaid debit card, loaded with a foreign currency. However, these days some neo-banks have begun offering Global Rupee travel cards. That’s a new type of card in the highly-competitive market of credit, debit and prepaid cards. Which one of these works out better?

What is a forex card?

Typically, forex cards are denominated in several foreign currencies. The US dollar, Australian dollar, UK pound, euro, dirham and Singapore dollar are some of the foreign currencies made available via forex cards.

For other currencies, you can still use a US dollar-denominated card, as that’s accepted in most countries.

Forex cards are issued by most banks, including Axis Bank, HDFC Bank, ICICI Bank, and others. There are fintechs like BookMyForex that also provides forex card at an interbank rate, without any mark-up or issuance charges and can be reloaded instantly from their app. “Forex cards don’t come with hefty currency charges and transaction fees, unlike debit and credit cards,” says Sudarshan Motwani, CEO and co-founder of BookMyForex.com.

What is a Global Rupee Travel card?

On the other hand, a Global Rupee Travel card gets loaded with the Indian Rupee. These cards can be used in 180 countries.

Niyo and Hop (rupee-forex debit cards), and Happay (pre-paid international card) are the three Rupee-denominated cards to choose from currently. To use Rupee debit travel cards from Niyo or Hop, a user has to open a bank account with the partner banks through websites or a mobile app. DCB, State Bank of Mauritius, YES Bank and Equitas Small Finance Bank have partnered with neo-banks for distribution of these global INR cards.

To apply for a pre-paid travel card of Happay, a user does not require any savings account. They can purchase it through foreign exchange agents or card distributors.

“Global Rupee travel card is better than debit and credit cards because when you use these cards abroad, you pay hefty charges while spending,” says Ananth Reddy, MD of Electrum Financial, involved in distribution of Happay Card.

Opening a new bank account

When you buy a Global Rupee travel card from Niyo or Hop, you need to open a bank account with a partnered bank of the distributing firm. “This account will be of no use later because it may get dormant. You also need to maintain a minimum balance and annual fee/renewal fee,” says Motwani.

While using a forex card there is no such hassle.

Ease of getting the card and loading

You need to plan well in advance if you opt for a Global Rupee travel card because it requires opening of a bank account with their partner bank which carries out all compliances such as KYC verification, address verification, etc. and hence, it takes about a week to receive it and to activate the card. “In forex cards, you just need to book an order online and you get the delivery of the card in one to two days,” says Motwani.

You can load the Global Rupee travel card on the go, as it allows you to transfer funds to the bank account associated with it via IMPS / NEFT / RTGS / online banking.

Reloading a forex card is also easy. You need to give an authorisation letter to the bank before traveling abroad, or nominating someone. If a forex card is issued from the same bank in which you have a bank account, you can do it via a net banking facility instantly. Puneet Kapoor, President – Products, Alternate Channels & Customer Experience Delivery, Kotak Mahindra Bank says, “It is very convenient and easy to reload a Kotak forex card. On internet banking or the Kotak mobile banking app, you just select the currency and amount, purpose and your a/c number that will fund the card.” He adds, that in the absence of internet and mobile banking access, a customer can load the Kotak forex card by visiting our bank branch and need to give us a simple request to load the chosen currency on the forex card.

Volatility in forex rate

Forex cards offer protection from volatility in rates. In forex cards, the forex rate is locked as soon as you load the money into it. For instance, if you are loading the forex card with one USD at Rs 79, then even if the rupee depreciates to Rs 82 per USD while you are traveling abroad, it will not have any impact. “When you opt to buy a forex card from your existing bank, there is a possibility the bank will offer you preferential rate for forex which can be lower while loading the amount,” says Ravisutanjani Kumar, a credit card enthusiast and Vice President – Partnerships at Testbook.

However, in the Global Rupee travel card, the currency rates are not fixed. The forex rates are applied at the real time of the transaction when you swipe your card while traveling abroad. For instance, you have the Global Rupee travel card and are transacting in US dollar, Australian dollar or any other foreign currency while traveling, you don’t have any control on the forex rates which will be applied at that time because of currency fluctuation.

“However, a Global Rupee travel card is a better option to use after returning to India, as the currency loaded is INR,” Kumar says. He adds a user cannot use the forex card at any offline and online transaction in India because the foreign currency loaded may be AUD, USD or some other foreign currency. “The re-conversion fee is 2-3 percent on the forex card. On the rupee card there is no such fee,” says Reddy.

Compare the cost and fees

Global Rupee travel cards come with low currency conversion fee, i.e. 1-1.5 percent compared to 5-6 percent for credit and debit cards, and 1-4 percent for forex cards. “Happay offers a pre-paid international card that can be loaded in Indian rupees and you don’t face the steep conversion charges that are applicable on the regular forex cards,” says Reddy. He adds, once you are back in India, you can use this same pre-paid card locally, too, at ATMs and merchants. You don’t have to incur any conversion charges. You wouldn’t have to worry about currency rate fluctuations, as it is a domestic card.

Experts caution travellers to not fall prey to claims of ‘no charges’ by some sellers of rupee travel cards. In terms of bank account activation or card joining fee, you would be paying a fee to the neo-bank. Even though some neo-banks have advertised the ‘zero mark-up fee’ for global Rupee cards, remember that these cards are based on Visa rates, not interbank rates, which could be up to 1 percent higher than the interbank rate. Motwani says, “Forex cards usually carry a premium over inter-bank rates and banks charge around 2 to 3 percent mark-up but BookMyForex offers zero forex mark-up over inter-bank rates.”

When you go abroad and use the Global Rupee travel card to withdraw cash from ATMs, your bank charges you exorbitantly on such foreign transactions. Compared to that, the ATM withdrawal charges on forex cards are fixed and transparent, i.e. around 2 USD per withdrawal.

Also read: Want a hassle-free holiday? Take care of these money matters

Evaluate the customer service

Customer service plays a vital role while selecting a forex card or Global Rupee travel cards. “A bank or a fintech operating in the domain for over five years might have a wider coverage and know-how to handle customer grievances, escalations based on their experience versus someone who is very new to these card offerings,” says Kumar. It’s important to receive timely support from the card issuer firm when you are traveling abroad through multiple mode of communications.

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.